Thursday 27th February 2014 – Pre Market Note

2 min read

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_2″ last=”no”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

Jobless Claims/Durable Goods 8.30am ET

-

Nat Gas Inventories 10.30am ET

-

Yellen Speaking 10.00am ET

[/fusion_checklist]

[/fusion_builder_column]

[fusion_builder_column type=”1_2″ last=”yes”]

[fusion_checklist icon=”signal” iconcolor=”light” circle=”yes”]

-

DAX weak so far in European session

-

Stock traders watchlist: TSLA, JCP, FSLR, BBY

-

JCP Beat earnings estimates +11%

[/fusion_checklist]

[/fusion_builder_column]

Overnight trade has seen both the YM and ES test outside of the range we’ve been stuck in for the last few days. 16140 has been a significant level for a while now and a heavy DAX helped push the YM to an overnight low of 16102. As I type the market has pulled back right to the break point which is almost coinciding with the VWAP.

Yellen is speaking at 10AM EST so it’s possible volume will dry up fairly quickly after an initial opening burst as traders wait to hear what she has to say.

Ukraine news seems to be getting worse, rumors of Russian military preparing to invade are circling. At the moment they are only rumors but it’s worth monitoring that closely as I can’t expect that Russian boots in Ukraine will go down well with the markets. Similarly if it resolves itself without any problems it’s one less thing for the Bulls to worry about.

Yellen is the big risk event today at 10am EST. Markets rallied last time she spoke but traders will be listening to any change in her tone or any hints that the economy isn’t as strong as first thought.

Everything seems on hold for now as bad econ data is blamed on the weather, markets are giving it the benefit of the doubt for now. But any hint that it’s not just about the weather will likely upset things. 2013’s rally was all about 2014 delivering great growth, if it fails to deliver then I’m not sure investors will be impressed.

Good trading all,

[fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_separator top=”40″ style=”shadow”/]

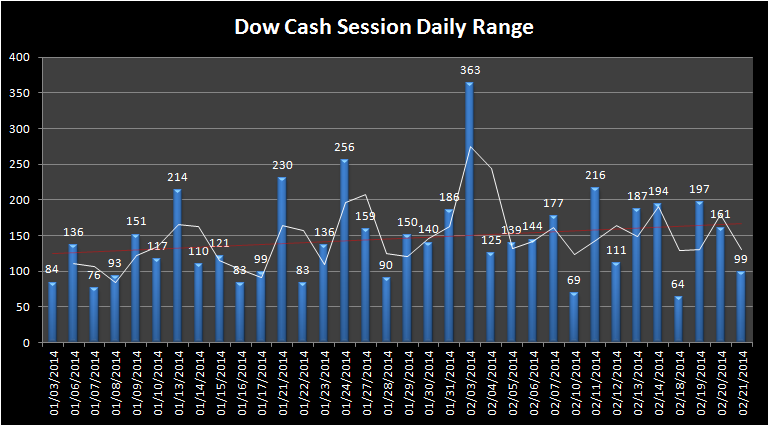

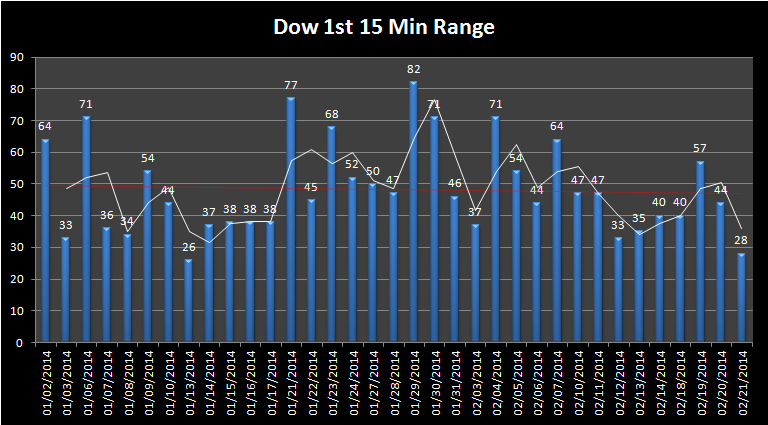

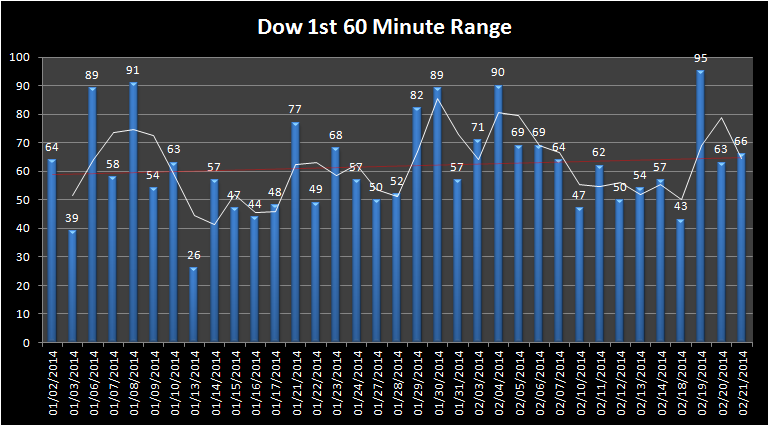

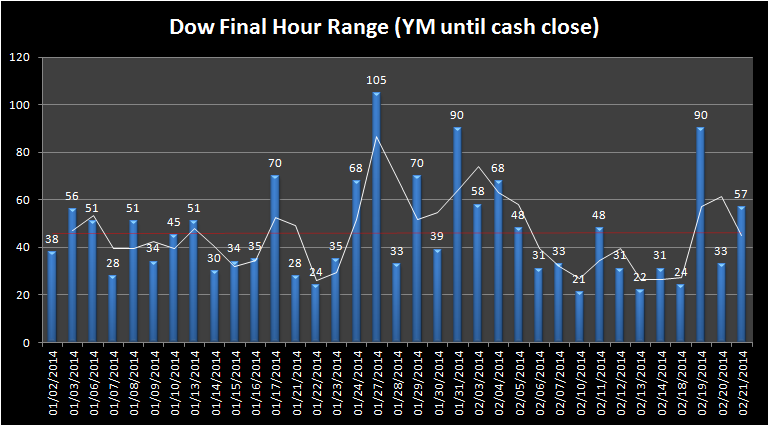

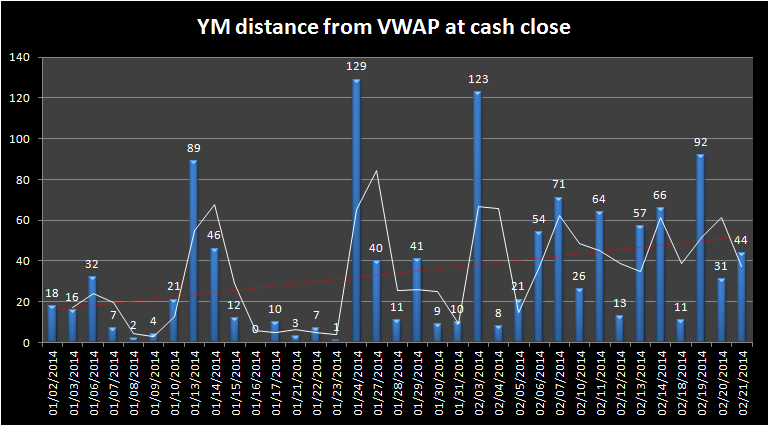

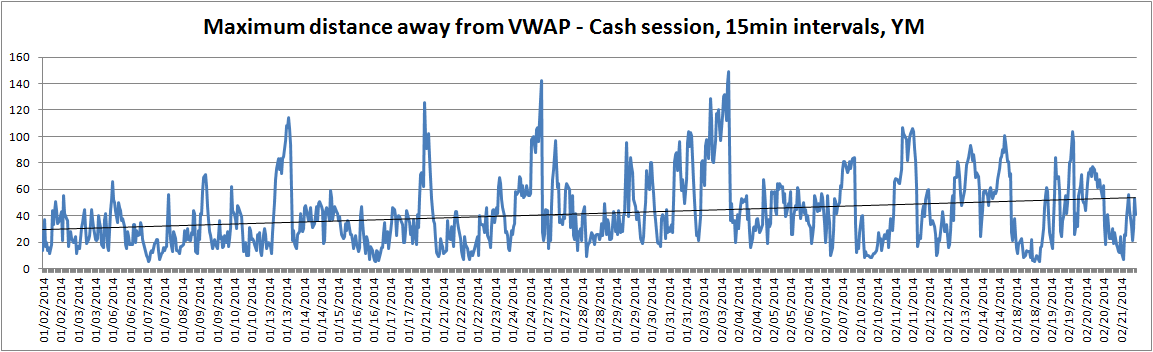

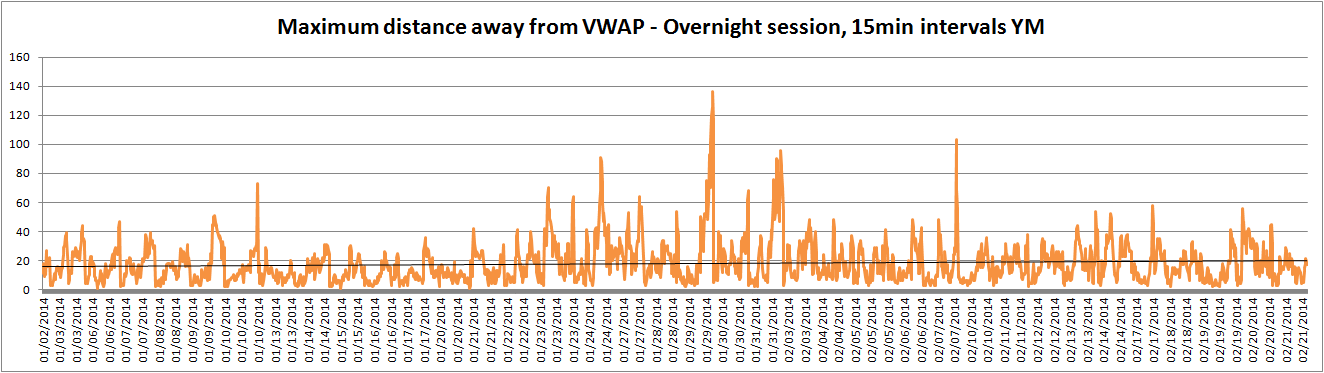

Market Ranges – Data taken from first trading day of 2014 to 21st February 2014, updated each Monday

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]