What I should have done….

2 min readWhat I should have done, but didn´t because I couldn´t.

When I first started out trading for real, I tried to create a trading routine because it made a lot of sense and anybody who´s somebody seemes to do just that.

The problem back then, not so long ago actually, was that I really didn´t know what was suppose to be in a trading preparation routine. I had to read what other traders was doing.

I also asked Mark, but he doesn´t give you recipes, ooh no.

The more I thought and read about it and the more I tried to create my hopelessly complex routine, the more I started to realize, that it can be quite a simple process.

The thing is: A trading routine is individual. You simply can´t copy someone else´s, it just ain´t doable.

For me, it´s absolutely necessary to have a schedule for the day and week, and it´s not just about drawing S/R levels and study charts.

I always thought that a flexible mind is a good thing to have, I still do. The problem with too much flexibility can be, that you start to trust that you will always be able to solve any problem or whatever comes up, instant.

Routines just makes you feel trapped. This might be true, but I feel it´s a totally different story if the routine is created by yourself and it´s created by your own experiences:

- You know that you sometimes chase the market, and the chasing will not go away, then you make a routine to prevent it to happen.

- You know that, if you´re not able to train during the day, you will feel stressed, maybe not today but later in the week.

- You know, that if you just write a little comment after each trade, how you felt and if it was good, you feel more professional.

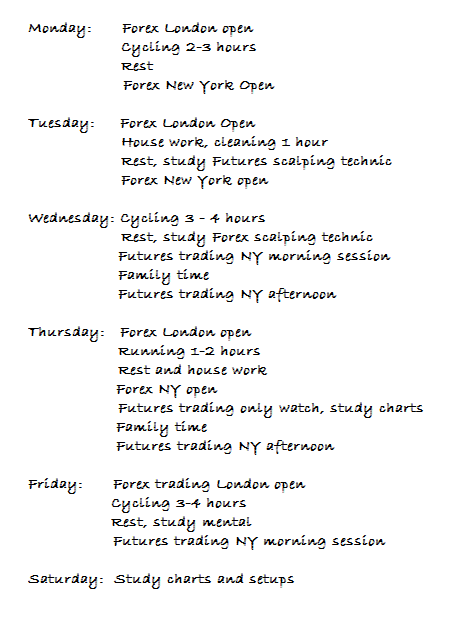

First a weekly schedule, create sunday before each week:

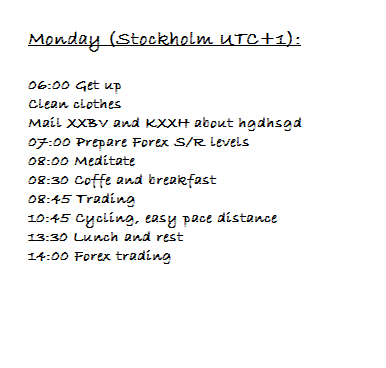

Then the daily schedule, created the night before each trading day:

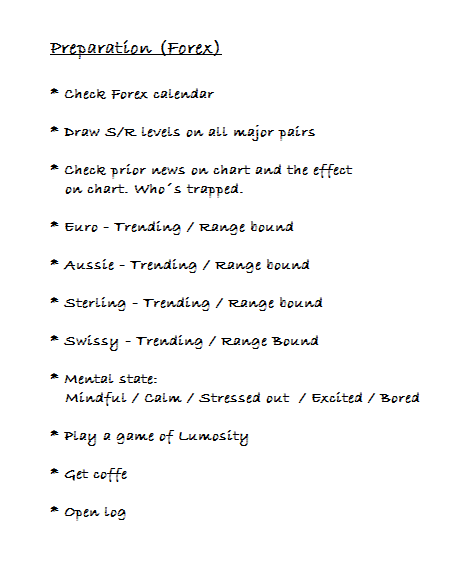

Then it´s preparation before each trading session ( this one for forex):

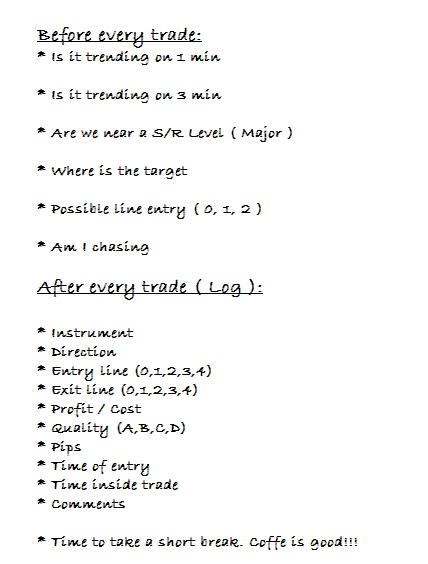

Last, and probably most important. Preparation and afterwork for each trade:

Money management

I´ve said it before and I will say it again:

Money management is extremely important, because first then are you able to make all this small mistakes and mature to hopefully, some day, become a successful trader.

/J