Scalping the Bobl

3 min readToday (friday), I was very confused what was going on with the Eurex Bobl and Schatz.

Schatz showed relatively high volume all morning and also very low delta for bid/ask. At the same time the Bobl´s volume was quite low and bid/ask delta was around zero. Both prices were at yesterdays close and high at todays range.

My mind was set for just sit and watch, maybe I´d learn something today.

All of a sudden, I started to feel more comfortable what was going on, after the buyers started to show some strength, not very aggressive but they were kind of buying up and wasn´t letting the price move down anymore.

I started to focus on the tape a bit more now and waited for a good entry to go long. Not for a big move, rather a short burst for 5-6 ticks. The sad thing was that I thought I should have a sip of coffe first, that’ll usually take me a couple of seconds. While I´m taking my coffe, I see the sign I´ve been waiting for since 2 am this morning (ET), that´s two hours.

Sellers hitting the bid at 124,95 and the bid not only sticks, someone is pushing in more contracts, we have an iceberg. An iceberg before a possible break a few ticks below a recently tested price, the “correlated” instrument is with you, you´ve had a bullish bias for last 30 minutes. What more can you ask for?

It wasn´t all that bad, I got in at 125,97 on the next pullback, but it would have been nice to have that perfect entry.

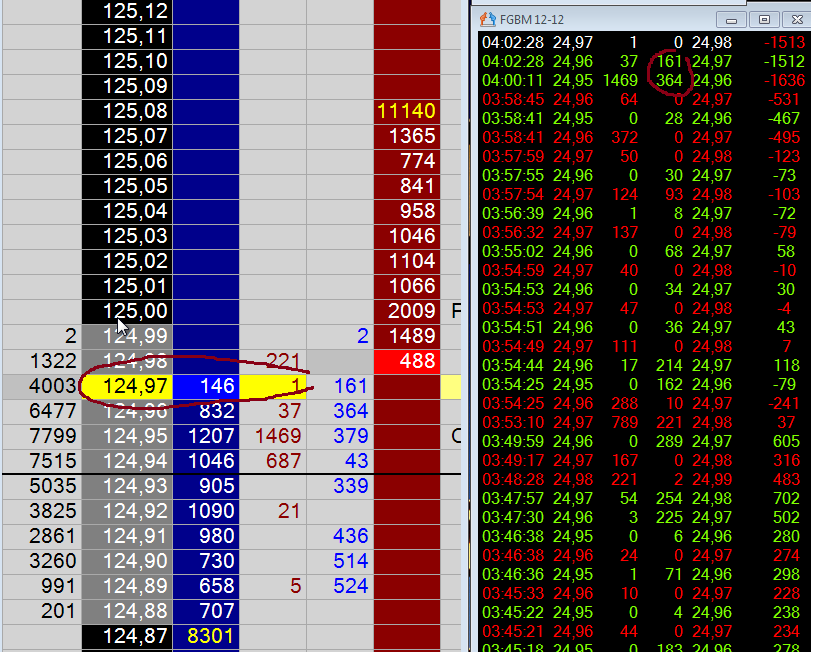

It all ended with a short burst up to 125,03 and that was exactly what I was hoping for. There was actually a naked VPOC up at 125,25 but I don´t use that as target, it´s too far away for me, but others might see that as a target and that lowers the odds even more.

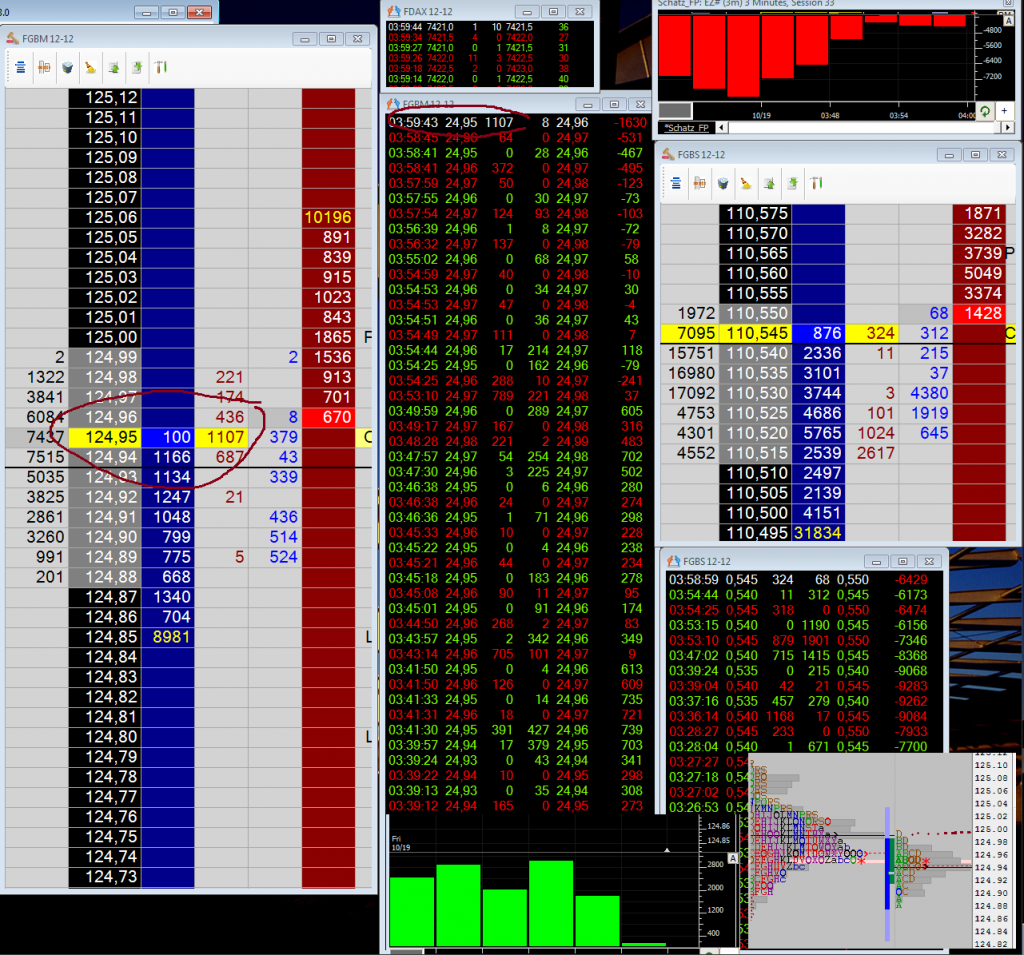

* Image explanation:

Left is DOM for Bobl

Middle is T&S for Bobl,

above is T&S for DAX futures

below is cumulative delta (graphic view MarketDelta) for Bobl

Right is DOM for Schatz

above is cumulative delta (graphic view MarketDelta) for Schatz

below is T&S for Schatz

far below is Market Profile for Bobl (MarketDelta), just to give a broader picture

The bid was 1000 I think before they were hitting it. See it gets hit with 1107 contracts and the bid sticks. There´s also signs from Schatz at T&S for more aggressive buying from 03:47 am(ET)

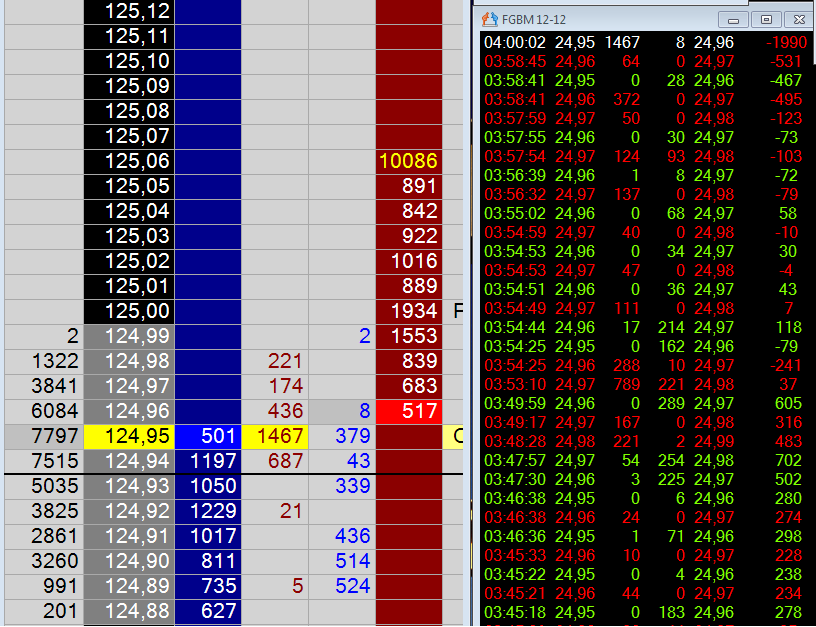

125,95 gets hit with 300 more and the bid gets filled with more than 500. Now you know it´s time to get in too. I normally put half on the limit and half on market (125,96), since I might not get lucky to be filled on the

limit order.

two minutes later 124,97 is bid, 125,96/97 was taken out failry easy. If you got filled at 125,95, it´s a joy to sit and wait for the break. Personally I came in a bit late, on 97, wasn´t filled at 96 on the small pullback, but was quite happy anyway.

It´s friday, the week has been amazingly good, I got a nice little scalp as a last gift. Now it´s time for a walk with my newly bought audio book (Schwagers, Hedge fund market wizards) in my ears.

/J

Ps. Maybe it´s not about the tools, but I have to say that Jigsawtrading Depth&Sales in combination with Summary tape is, well it´s amazing.