First trade of the year – Welcome back

2 min readWelcome back traders. Here’s to a profitable 2011.

I’m going to take it easy this week, I’ll be looking for opportunities as always with one or two good trades the goal until all the market participants get back, have their new years meetings and start shuffling money around again.

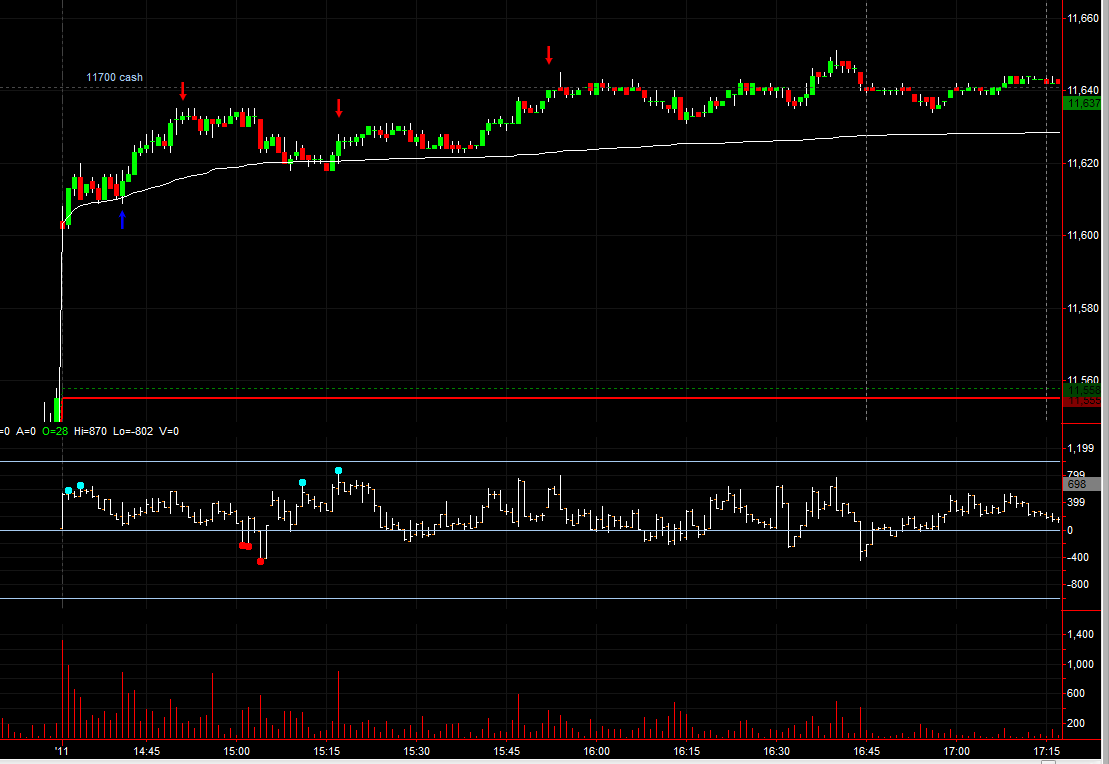

So the German’s kicked off 2011 to a strong start with a +100 drive in the first few hours. This dragged up the US markets pre open giving us a strong pre market move.

When we get a move like this overnight I have no reason to expect it not to at least make another good push, if not turn into a trend day. So I watch the open closely, we opened at the overnight highs and continued to push on. Then came the pause…… this is the key point, do I see any sellers? If not that activates my long bias and then I am looking for a trigger to get in long.

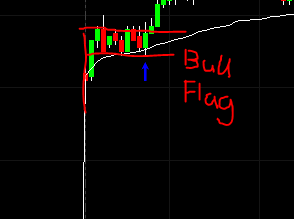

I didn’t get the pullback I was quite looking for but a small bullflag that was bought heavily as it dipped towards the low of the flag was the trigger I needed.

The market broke through the flag and pushed higher. A logical place for a stop was under the flag so the risk was reasonably low. My final target was a probe of the 11,700 level on the DOW cash. 11,640 YM equivalent.

This is new territory for the market so a good trend day would not be unreasonable. First day of the year who knows how fund managers are distributing their assets.

I took my first scale on the next push higher in the TICKS. The move seemed subdued so it made sense to cut some risk and take half off the table. I pulled my stop to break even and held on for final targets.

The market pulled back to the VWAP on low TICKS and then put in an immediate high TICK reading fairly soon after with the day’s high still a fair way off. With this mixed signal I closed another batch.

My final 11,640 YM target (11,700 cash) was hit 45 minutes later and I took that as my cue to close the lot. The volume had died off somewhat after the initial burst and there seemed no strong reason for me to hold anything more.