4,3,2,1 Go!

3 min readWhen I first started out with trading, I bought myself four 24″ monitors and put them on a rack. I also had to buy a high end graphic card that could handle all four monitors.

On the monitors, I had everything from forex pairs, candlestick charts in different time frames, some breadth indicators and a couple of “related” instrument. Nothing wrong with that, it was good for the trading style I had at the time.

The longer I´ve been trading, the less information I want to have when I trade. The information that doesn´t give me an extra edge, I simply don´t want see.

I am now down to one single monitor, a 27″ high quality Dell U2711, resolution 1920×1200. I also trade a totally different style than I used to.

Pros:

- It´s good for my eyes and head, with less radiation.

- It´s good for focus, less place to put unnecessary info

- It´s good for recording, I can record the whole monitor with all the info I had at the time, for analyze later on.

- It´s good when I host webinars. The participants see exactly what I see.

- It´s good for the environment.

- It´s easy to move the setup to a different computer, I could have it hosted on a cloud server if I want to. (That´s my next project btw).

Cons:

- If I have friends coming over to my office, they usually get disappointed, there suppose to be at least four monitors if you´re a daytrader right?

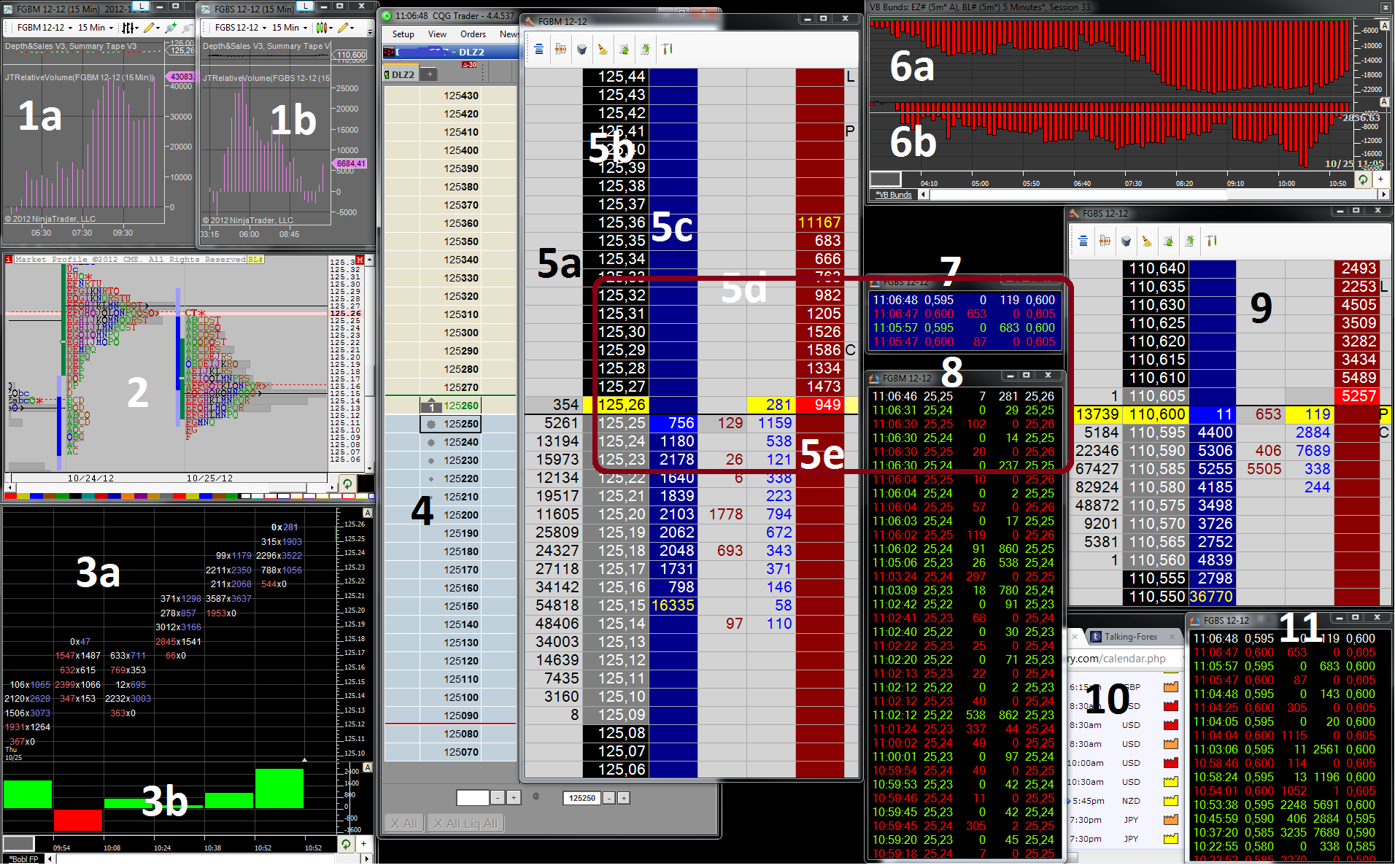

Some explations of what I´m looking at while trading, and for preparation. I trade Eurex bunds, Bobl and Schatz

On Ninja its symbol is FGBM and FGBS. On MarketDelta its BL and EZ.

- 1: Relative volume indicator (Jigsawtrading) for NinjaTrader. An indicator that shows the current volume relative to average the last 60 (customizable) days of trading. A (Eurex Bobl) – B (Eurex Schatz)

- 2: Market Profile (MarketDelta) for Bobl for the last two days. I use this for preparation, levels are Yesterdays close, naked VPOCs and some obvious rejected prices if there is any nearby.

- 3a: Footprint (MarketDelta) for Bobl. I use 5 tick range. Very good to see local high volume nodes that I can lean on for my stops.

- 3b: Volume breakdown (MarketDelta) for Bobl. Same range as footprint, it´s the delta volume traded on bid vs ask.

- 4: CQG Trader Lite. My execution platform. The best substitute for now (explained later). CQG has very low commission.

- 5: Jigsawtrading Depth&Sales, an indicator for NinjaTrader. You could say it´s a DOM on steriods. At the moment, you can´t execute from it, that´s why I use CQG for now.

- 5a: Total volume traded at each price.

- 5b: Price

- 5c: Bids

- 5d: Current traded at bid and ask

- 5e: Offers

- 6: Volume breakdown (MarketDelta), accumulated for the whole day

- 6a: Eurex Bobl

- 6b: Eurex Schatz

- 7: Summary tape for Schatz, Time&Sales on steriods (NinjaTrader/Jigsawtrading)

- 8: Summary tape for Bobl.

- I like to have Schatz tape close to Bobl tape/DOM, because sometimes Schatz triggers a move on the Bobl.

- 9: Depth&Sales for Schatz

- 10: Calendar (forexfactory.com), behind it is Talking forex (radio channel)

- 11: Summary tape for Schatz. Same as 7, but with more rows.

The red square is where I have my eyes focused on when it´s time to enter a trade. I have all info I want before focus, and just wait for the trigger to enter. Often it´s a large order on the Schatz that makes me push the button.

A great feature in the Jigsawtrading suite, is an alert sound for large bids and offers.

/J